Analysing the next bullrun

Sept 26, 2023 | #non-technical#economics

In this comprehensive article, we delve deep into the cryptocurrency market, exploring the factors that could trigger the next crypto bull run and shape its magnitude. From economic influences like inflation and institutional investment to the impact of evolving regulations, we dissect the dynamics at play. We also unravel the relationship between Bitcoin's cycles and broader crypto trends and analyze historical patterns for insights.

1.Introduction

The cryptocurrency market has, over the past decade, evolved from a niche curiosity to a global financial force to be reckoned with. It's a realm where fortunes are made and lost in the blink of an eye, where innovation meets speculation, and where the financial landscape is being reshaped before our eyes.

In this ever-evolving landscape, one phenomenon has consistently captured the attention of investors, speculators, and enthusiasts alike: the crypto bull run. It's not just a surge in prices; it's a tidal wave of enthusiasm and investment that can reshape the entire market. As we embark on this journey into the world of cryptocurrencies, we'll explore the significance of a potential crypto bull run, a phenomenon that can send shockwaves through the financial world.

In this article, we'll dive deep into the factors that have the potential to ignite the next crypto bull run and influence its magnitude. We'll traverse the economic landscape, examining how global forces, institutional interest, and market dynamics can play a pivotal role. We'll also explore the regulatory environment and its potential impact on the crypto market, an increasingly critical factor in today's interconnected world.

Furthermore, we'll journey through the heart of the crypto market, focusing on Bitcoin's cycles and their role as a bellwether for the broader digital asset ecosystem. We'll delve into historical comparisons and patterns, drawing upon past bull runs for insights into what might lie ahead.

2.Understanding the Crypto Market Dynamics

2.1 Volatility

It's widely known that cryptocurrency markets exhibit extreme volatility. In fact, the crypto market is renowned for its exceptional liquidity, making it one of the most fluid markets globally. It's not uncommon to witness price surges of over 100% or dramatic declines of 100%. That rapidly changes the mood of the market and it can easily go from extreme greed to absolute panic.

2.2 The Historical Significance of Bull Runs in Cryptocurrency

For those not well-versed in the dynamics of a bull run, it represents a period of remarkable prosperity and robust economic growth within the cryptocurrency market. Conversely, its antithesis, the 'bear market', is currently holding sway as we write this. It's crucial to note that the last bull run, or bull market, unfurled in the remarkable stretch from 2020 to 2021, culminating in Bitcoin's ascent to a staggering peak of over $63,000 in October 2021. Presently, the cryptocurrency giant hovers at a comparatively modest $25,000, underlining the cyclical nature of these market dynamics. This stark contrast serves as a testament to the profound significance of bull runs within the cryptocurrency ecosystem.

Here are some of the defining characteristics that typically accompany a bull market:

-

Explosive market capitalization Growth: The total market capitalizationitalization surges to multiples of its bear market counterpart.

-

Proliferation of New Ventures: A surge in new cryptocurrency projects, reflecting the heightened optimism and appetite for innovation during these periods.

-

Flourishing Opportunities in Web3: The demand for web3-related skills and employment opportunities reaches a zenith, as blockchain technologies gain further traction.

-

Exuberant Optimism and Hype: Bull markets are often marked by an excess of optimism and an overarching sense of euphoria among investors.

-

Exaggerated Price Swings and Profits: Prices witness rapid, sometimes exaggerated, increases, driving substantial profits for early investors.

These are hallmarks of a bull market, encapsulating both the opportunities and risks that come with this exhilarating phase in the cryptocurrency journey.

BTC/USDT historical chart

2.3 Importance of analysis

Investing in cryptocurrencies may seem like a lucrative endeavor during a bull run, but this enthusiasm and wealth accumulation can be short-lived. To outperform the market and prepare for the inevitable downturn at the end of a bull run, thorough analysis is essential. While cryptocurrency markets are not an exact science, we can identify patterns and make predictions by analyzing various factors.

3. Economic Factors

Economic factors play a significant role in influencing the sentiment and behavior of the cryptocurrency market. Factors such as the expansion of credit, attention-grabbingnews, or even a single tweet can trigger impulsive buying or selling of assets.

Additionally, regulatory speculations, like those concerning the SEC, can directly impact the capital flowing into the crypto ecosystem.

3.1 Inflation and the devaluation of fiat currencies

One of the key economic drivers affecting the cryptocurrency market is inflation and the devaluation of fiat currencies. When a currency experiences high levels of inflation, savers and investors become wary of holding onto it, as it steadily erodes their purchasing power. People often seek to preserve their wealth by exchanging the devaluing currency for consumer goods or other tangible assets like gold or alternative currencies.

This phenomenon is particularly common in countries with highly devalued national currencies, such as Argentina, so this kind of countries are early-adopters and hey are contributing to mass-adoption. To illustrate the impact of inflation on major reserve currencies, let's examine the supply dynamics of two prominent currencies: the USD and Euro.

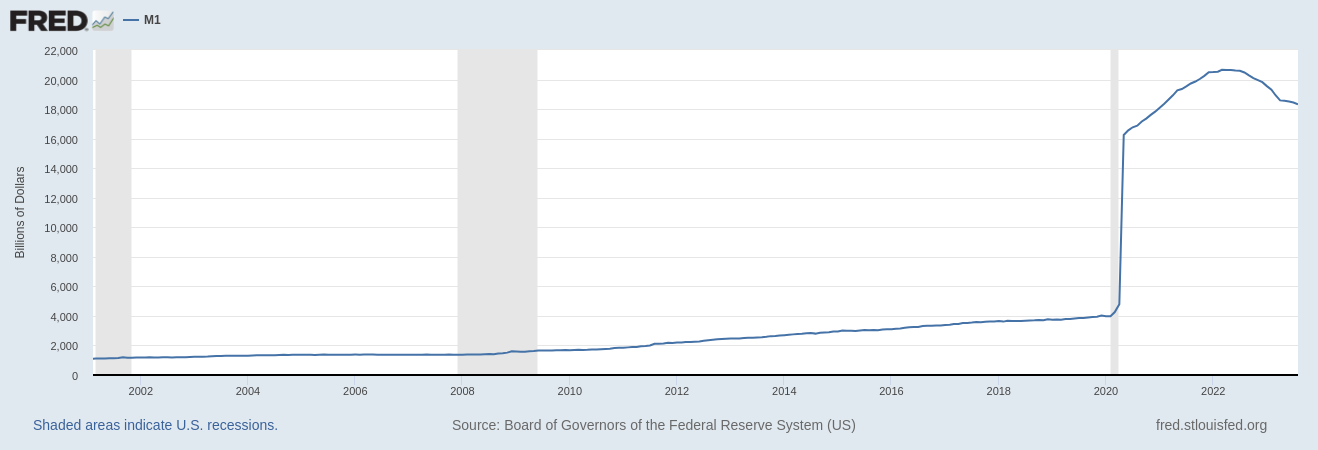

USD money supply over time

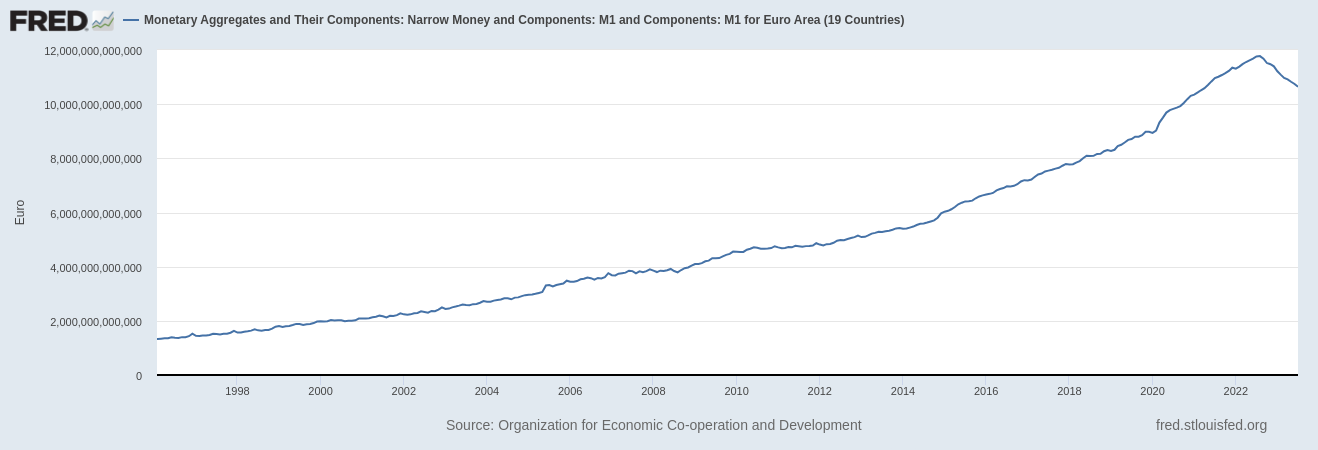

EUR money supply over time

As evident from the graphs, both the USD and Euro have experienced significant increases in their money supplies over the past two decades. The Euro's supply has surged by 600%, while the USD's supply has witnessed a staggering 1,000% increase. Notably, the USD underwent a substantial devaluation in 2020, with its supply skyrocketing from approximately 4,000 billion to over 20,000 billion in just two years.

We can see this happening and even worse in lots of fiat currencies worlwide. This opens a new world of opportunities for crypto, since this phenomenon can make . They even prohibited owning them invest cryptocurrencies that can mantain their value over time.

3.2 Institutional interest and investment

Financial institutions often symbolize confidence for many cautious investors. The news of renowned institutions choosing to invest in assets like Bitcoin is remarkably encouraging, as it helps dispel the misconception that all cryptocurrencies are inherently fraudulent, which is a common belief among the general public. Here are some of the institutions that have previously announced their intention to include Bitcoin investments:

-

Grayscale Investments: While not a traditional bank, Grayscale is a significant player in the cryptocurrency investment space. It offers various cryptocurrency investment trusts, including the Bitcoin Investment Trust (GBTC), which allows institutional investors to gain exposure to Bitcoin.

-

MicroStrategy: A publicly-traded business intelligence firm, MicroStrategy made headlines by converting a substantial portion of its treasury reserve into Bitcoin. The company continues to invest in Bitcoin as a hedge against currency devaluation.

-

Tesla: In early 2021, Tesla, an electric vehicle manufacturer led by Elon Musk, announced that it had purchased $1.5 billion worth of Bitcoin and would accept Bitcoin as payment for its products.

-

Square: The payments company founded by Jack Dorsey (also the CEO of Twitter) invested $50 million in Bitcoin in 2020 and has been actively promoting cryptocurrency adoption through its Cash App.

-

Fidelity Investments: Fidelity, one of the world's largest asset managers, has launched Fidelity Digital Assets, a subsidiary dedicated to offering cryptocurrency custody and trading services to institutional clients.

-

Guggenheim Partners: Guggenheim, a global investment and advisory firm, filed with the SEC to allocate part of its Macro Opportunities Fund to Bitcoin in late 2020.

-

Paul Tudor Jones: While not an institution per se, Paul Tudor Jones, a billionaire hedge fund manager, publicly disclosed his Bitcoin investments as a hedge against inflation.

-

MassMutual: The Massachusetts Mutual Life Insurance Company purchased $100 million worth of Bitcoin in December 2020 as part of its general investment fund.

-

Stanley Druckenmiller: Renowned hedge fund manager Stanley Druckenmiller has expressed his interest in Bitcoin as a store of value, indicating that he owns some Bitcoin.

-

JPMorgan Chase: Although Jamie Dimon, JPMorgan's CEO, has been critical of Bitcoin in the past, the bank has reportedly started offering banking services to cryptocurrency exchanges, signaling some level of involvement.

3.3 Global economic instability and uncertainty

Global economic instability and uncertainty have been pivotal factors in driving the behavior of the cryptocurrency market during recent years. The interconnectedness of financial markets and the rapid dissemination of information in the digital age have made the crypto market increasingly sensitive to fluctuations in the global economy.

Geopolitical conflicts, such as trade disputes, territorial disputes, and sanctions, can create an atmosphere of uncertainty in the global financial landscape. These conflicts often lead to market volatility as investors seek safe-haven assets to hedge against potential economic fallout.

For instance, during the height of the U.S.-China trade tensions in 2019 and 2020, Bitcoin saw increased interest from investors as a hedge against the uncertainty surrounding traditional financial markets. The idea that cryptocurrencies are decentralized and immune to the influence of any single government or entity makes them attractive in times of geopolitical turmoil.

3.4 Central bank interest rates

As previously mentioned, in the tumultuous year of 2020, marked by the COVID-19 pandemic, both the United States and the Eurozone took measures to increase their money supply. The U.S. initiated this move, leading to exceptionally low interest rates and virtually cost-free access to credit, effectively stimulating its economy. The European Union followed a similar path, bolstering its economy through accessible credit.

However, the repercussions of this expansive monetary policy soon became evident. By May 2022, the year-on-year Consumer Price Index (CPI) in the United States had surged to 9.1%. Shortly thereafter, the Eurozone also grappled with inflationary pressures. Coupled with certain geopolitical conflicts, the Eurozone's average year-on-year CPI soared to 10.6% by October 2022. Some European countries, Estonia in particular, experienced even more pronounced inflation, reaching an alarming 24.8% year-on-year CPI in August 2022.

In this inflationary context, driven by factors beyond monetary policy alone, central banks began taking corrective measures by gradually increasing interest rates.

Currently, the Federal Reserve's interest rates have surpassed 5%. Considering that just two years ago, they were hovering around nearly 0%, this represents a significant shift. Elevated interest rates and persistent inflation paint a challenging economic landscape.

When the Federal Reserve interest rate is high, banks are discouraged from borrowing from each other, and the supply of cash in the economy decreases. This means consumers and banks are borrowing and spending less, which can cause the economy to slow down.

The truth is that it has been a long very time since we saw this high interest rates in western countries, we lived in a dream of permanent cheap credit. Experts say we won't get back in a long time neither. This creates without a doubt a very uncertain scenario for investors.

| DATE | FEDERAL RESERVE INTEREST RATE |

|---|---|

Sept. 20, 2023 | 5.25%-5.50% |

July 26, 2023 | 5.25%-5.50% |

June 14, 2023 | 5.00%-5.25% |

May 3, 2023 | 5.00%-5.25% |

March 22, 2023 | 4.75%-5.00% |

Feb. 2, 2023 | 4.50%-4.75% |

Dec. 14, 2022 | 4.25%-4.50% |

Nov. 2, 2022 | 3.75%-4.00% |

Sept. 22, 2022 | 3.00-3.25% |

July 28, 2022 | 2.25%-2.50% |

June 16, 2022 | 1.50%-1.75% |

May 5, 2022 | 0.75%-1.00% |

March 17, 2022 | 0.25%-0.50% |

March 16, | 2020 0%-0.25% |

March 3, 2020 | 1.00%-1.25% |

Oct. 31, 2019 | 1.50%-1.75% |

Sept.19, 2019 | 1.75%-2.00% |

Aug. 1, 2019 | 2.00%-2.25% |

Dec. 20, 2018 | 2.25%-2.50% |

Sept. 27, 2018 | 2.00%-2.25% |

June 14, 2018 | 1.75%-2.00% |

March 22, 2018 | 1.50%-1.75% |

Dec. 14, 2017 | 1.25%-1.50% |

June 15, 2017 | 1.00%-1.25% |

March 16, 2017 | 0.75%-1.00% |

Dec.15, 2016 | 0.50%-0.75% |

Dec. 17, 2015 | 0.25%-0.50% |

4. Regulatory Environment and Its Impact

The regulatory landscape surrounding cryptocurrencies is a subject of paramount importance, as it directly interfaces with traditional fiat currencies. When Bitcoin emerged in 2009, it operated in a regulatory vacuum, largely flying under the radar due to its nascent status. However, as cryptocurrencies gained traction and popularity over time, they inevitably drew the attention of governmental and regulatory bodies, such as the U.S. Securities and Exchange Commission (SEC).

Regulatory alterations hold the potential to significantly influence market sentiment. The decisions made by these powerful institutions can have far-reaching consequences, impacting the value of assets worth millions or even billions of dollars. Therefore, it's imperative not to underestimate their significance.

Cointelegraph article

A prime example of regulatory impact can be observed in China's stringent measures against Bitcoin mining and ownership, affecting a nation with over a billion inhabitants. The immediate repercussions of these actions were visible in Bitcoin's price fluctuations. As of now, several countries have either restricted or outright prohibited Bitcoin usage, including:

- Algeria

- Bangladesh

- Bolivia

- China

- Colombia

- Egypt

- Indonesia

- Ghana

- Iran

- India

- Iraq

- Kosovo

- Mexico

- Nepal

- North Macedonia

- Russia

- Turkey

- Vietnam

For institutional investors, regulatory clarity is a pivotal factor in their decision-making process. They are obligated to adhere strictly to the law, and any ambiguity or onerous regulations can deter them from considering cryptocurrencies as viable investments. Excessive regulation and government intervention can also elevate the perceived risk to a level that outweighs potential profits, rendering the risk unjustifiable. Hence, the regulatory environment plays a crucial role in shaping the future of cryptocurrency markets.

5. Bitcoin as a mainstay of the markets

5.1 Bitcoin market capitalization

The cryptocurrency market is intrinsically tied to the ebbs and flows of Bitcoin. Remarkably, Bitcoin's market capitalization typically accounts for approximately 50% of the entire crypto market capitalization, rendering it a key barometer of market sentiment.

During a bull run, a recognizable pattern unfolds: Bitcoin's price surges first, followed by Ethereum, and then a flurry of activity in the realm of alternative cryptocurrencies, often referred to as the "alt-season". This dynamic is effectively captured by the "Bitcoin dominance" graph, which charts Bitcoin's share of the total market capitalization. A peak in Bitcoin dominance typically signals the onset of a bull run, while a subsequent decrease often indicates the onset of the altcoin season.

5.2 Bitcoin halving cycles

One undeniable aspect of Bitcoin's nature is its cyclical behavior. This predictability is attributed to Bitcoin's open-source code, which allows anyone to inspect the underlying protocol. At the heart of this cycle lies the concept of "Bitcoin halving."

Approximately every four years, Bitcoin's block reward undergoes a halving event. This event results in miners receiving only half of the rewards they were previously earning. Consequently, Bitcoin becomes less inflationary over time, enhancing its scarcity and propelling its market price upward.

The most recent Bitcoin halving took place in 2020, leaving crypto enthusiasts eagerly anticipating the next one slated for 2024. Even if economic conditions are less than favorable at that time, the 2024 halving could serve as a catalyst for a new bull run, injecting momentum into the entire crypto market as Bitcoin's price appreciates. While the scale of this effect remains uncertain and may not rival the intensity of previous bull runs, it undoubtedly marks a noteworthy date on the crypto calendar.

6. Potential Challenges and Risks

While the prospect of a crypto bull run is exciting, it's essential to acknowledge the potential challenges and risks that come with it. Here are some key factors to consider:

6.1 Regulatory Uncertainty

The regulatory environment for cryptocurrencies remains uncertain in many jurisdictions. Changes in regulations can impact the legality, taxation, and overall market sentiment towards crypto assets. Investors must stay informed about regulatory developments and be prepared to adapt their strategies accordingly.

6.2 Market Volatility

Cryptocurrency markets are known for their extreme volatility. While bull runs can lead to substantial gains, they can also result in significant losses if not managed carefully. Investors should be cautious and consider risk management strategies, such as setting stop-loss orders.

6.3 Lack of Fundamental Valuation

Unlike traditional assets, cryptocurrencies often lack clear fundamental valuation metrics. Prices are driven by speculation, sentiment, and market dynamics. This can make it challenging to assess the true value of an asset, leading to price bubbles and corrections.

6.4 Security Risks

The crypto space has been susceptible to hacking and security breaches. Investors must take precautions to secure their assets, such as using hardware wallets, practicing good cybersecurity hygiene, and being cautious about phishing attacks and scams.

6.5 Speculative Investments

During a bull run, there is a risk of excessive speculation, with investors pouring money into projects without conducting proper due diligence. It's important to research and invest in projects with strong fundamentals and real-world use cases.

7. Conclusion and Future Outlook

In conclusion, the possibility of a crypto bull run holds both promise and challenges. The crypto market is influenced by a complex interplay of economic factors, institutional interest, regulatory decisions, and the behavior of key assets like Bitcoin. While past bull runs have shown the potential for explosive growth, investors must navigate risks and uncertainties.

Looking to the future, the timing and magnitude of the next crypto bull run remain uncertain. It could be triggered by economic instability, institutional adoption, or other unforeseen catalysts. However, the crypto market has proven resilient and innovative, and it continues to evolve.

As we move forward, it's crucial for investors to stay informed, exercise caution, and approach the market with a long-term perspective. While crypto assets offer exciting opportunities, they also require careful consideration and risk management. The crypto space is likely to remain dynamic, and its future holds the promise of further reshaping the global financial landscape.

8. References

- https://coinmarketcap.com/es/currencies/bitcoin/

- https://cointelegraph.com/news/will-china-ban-crypto-mining

- https://www.tradingview.com/symbols/BTC.D/

- https://www.fool.com/the-ascent/federal-reserve-interest-rates/

- https://fred.stlouisfed.org/series/M1SL#

- https://fred.stlouisfed.org/series/MANMM101EZM189S#